Initiatives in climate change, and public disclosure

We believe that solving climate change-related issues is the highest priority for realizing a sustainable society. The FANCL Group will tackle climate change from both mitigation and adaptation perspectives, taking into account the opportunities and risks that we can see from a long-term perspective looking to 2050. In all aspects of our corporate activities, we appreciate the blessings of nature and work to contribute to the conservation of the natural environment.

Corporate information disclosure requirements concerning climate change have increased worldwide. In October 2020, the FANCL Group announced its support for the recommendations of the TCFD※ in response to the TCFD※'s final report published in June 2017.

The TCFD recommendations include disclosure of information on each of the following topics related to climate change: governance, business strategy, risk management, and indicators and targets. Along with disclosing information in line with these four disclosure recommendations, we conducted scenario analyses and assessed the risks and opportunities associated with climate change.

The FANCL Group will continue to address climate change from a long-term perspective. We will deepen our understanding of the opportunities and risks that affect our business, and strive to actively disclose our initiatives.

TCFD:

The Task Force on Climate-related Financial Disclosures (TCFD), chaired by Michael Bloomberg, was established by the Financial Stability Board (FSB)* at the request of the G20 to examine how climate-related disclosures and financial institutions should be addressed.

*An organization comprising the financial ministries and central banks of each country, which is responsible for international monetary and financial supervision.

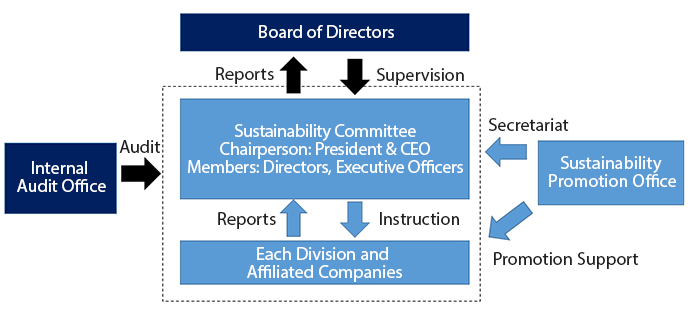

Governance The Sustainability Committee

The FANCL Group places sustainability at the heart of its corporate management. To enhance our corporate value, we hold meetings of the Sustainability Committee composed of Directors and executive officers four times a year. The Committee is chaired by our President & CEO, Representative Director. Our Board of Directors monitors and has oversight of sustainability initiatives while managing and assessing the progress toward targets.

Strategy

The FANCL Group formulated VISION2030, a long-term strategy looking toward the year 2030. We have been developing our business in pursuit of this vision. In June 2018, we formulated the FANCL Group Sustainability Declaration, and set CO2 emission reduction targets in line with our Sustainable Development Goals (SDGs). We expressed our intention to contribute to the realization of a sustainable society by reducing environmental impacts.

In our 3rd Medium-Term Management Plan Advance 2023, which began in the fiscal year ended March 2022, we gave the highest priority to climate change as the key environmental issue we must address, clarified our challenges, and revised our strategies. In May 2021, we announced our goal of zero CO2 emissions by fiscal 2050. We are actively promoting the reduction of our CO2 emissions. We have also set quantitative targets for reducing the amount of plastic used in product containers, and are procuring sustainable palm oil.

Risk Management

The FANCL Group is qualitatively analyzing assumed risks and opportunities, and is calculating financial impacts based on climate change scenarios that affect our overall business. Energy price fluctuations, carbon price trends, and fuel regulation trends were used as important input items in our analysis based on scenario RCP2.6 presented in the Fifth Assessment Report (AR5) published by the IPCC (United Nations Intergovernmental Panel on Climate Change) in December 2014. Our VISION2030 encourages full-scale globalization. Our business expansion overseas may have a significant impact on our manufacturing costs which include energy procurement and decarbonization taxes. In addition, there are many other risks to be expected, such as the risk of increasingly severe weather events due to global warming, the risk of tropical infectious diseases spreading to high latitudes, the negative impact of depletion and loss of yield in agriculture, forestry, and fishery resources, and the procurement risk of raw materials for our products that depend on these resources, as well as risk to our entire supply chain. In response to these risks, we are promoting the introduction of renewable energy and reducing CO2 emissions, developing eco-friendly products, procuring sustainable raw materials, and developing products in response to global warming and the spread of infectious diseases.

Risks and opportunities in climate change

(Assumed conditions)

- Targeted period:

- to 2030

- Scope

- Mainly our cosmetics business and health food business in 3 domestic sales channels (online and catalogue, direct stores, and wholesale)

- Calculation assumptions

- Calculate the estimated sales and profit impact within the target period for each item, based on the IPCC Fifth Assessment Report RCP2.6 (2°C scenario), ignoring the development of infrastructure such as public works and the evolution of technology

| Global changes | Risks and opportunities for the FANCL Group | Financial impact (JPY) | |

|---|---|---|---|

| Transition risks | Stricter policies and regulations to address climate change |

Increase in carbon tax costs If policies and regulations on CO2 emissions and plastic usage are strengthened to mitigate climate change, costs associated with investment for energy conservation, introduction of renewable energy, and reduction of plastic usage in products will increase. In particular, the introduction of a carbon tax is expected to increase the burden on the FANCL Group. As part of our countermeasures, we have installed solar panels at three of our domestic factories (in Shiga, Gunma, and Mishima prefectures) and at our Kansai Logistics Center. From April 2022 we switched to using renewable energy-derived power and carbon-neutral gas at our domestic facilities. |

Carbon tax costs * Assumed costs in FY Mar/2031 |

| Restrictions on going out due to the outbreak of infectious diseases, decrease in demand from tourists visiting Japan from overseas |

Decrease in store/wholesale sales It is predicted that infectious diseases will spread due to changes in water-borne infectious diseases and pathogenic vectors. If there is an outbreak of infectious disease, we expect that sales at our direct stores and wholesale sales will decline due to a reduction in sales to tourists visiting Japan (on account of travel restrictions) and Japanese deciding to stay at home instead of going out to do their shopping. |

Reduction in sales * Calculated with reference to COVID-19 |

|

| Physical risks | More intense weather abnormalities, rising sea levels |

Decrease in sales due to lower production capacity There is a risk of flooding due to rising sea levels and a risk of flooding due to overflowing rivers following torrential rain. The FANCL Group's Chiba Plant is located along the Edo River in Nagareyama City, Chiba Prefecture. The plant has a wing dedicated to the production of Mild Cleansing Oil, a major product. If the Edo River were to burst its banks and the plant to close (we assume a 1-month closure), sales of Mild Cleansing Oil would likely suffer. |

A decline in sales of Mild Cleansing Oil approx. ¥1 billion. Note. We assume that the factory will be shut down for one month. |

| Fall in production volume and decline in quality of raw materials derived from agriculture |

Increase in cost of raw material procurement We assume that there will be a fall in production volume and a decline in the quality of raw materials derived from agriculture, due to global warming and abnormal weather due to climate change. As a result, we assume additional costs such as rising raw material procurement costs and charges associated with switching over to alternative products. A decline in crop yields including Hatsuga Genmai rice and kale juice and difficulties in obtaining palm-derived raw materials such as glycerin, could have a significant impact on our business, increasing manufacturing costs. |

Increase in cost of sales of Hatsuga Genmai rice, kale juice, and palm-derived raw materials, etc. |

|

| Opportunities | Changes in consumer needs due to the outbreak of infectious diseases |

Increases in sales of products that meet these new needs In the event of an outbreak of infectious disease, consumer interest in health and hygiene will heighten, and demand for "immune system-supporting products," "hygiene products,” and associated services that meet new needs will likely increase. |

Increase in sales * Calculated with reference to COVID-19 |

|

Increase in online and catalogue sales If an infectious disease outbreak occurs, it is expected that demand for online catalog sales will increase due to people refraining from going out and from the closing of brick-and-mortar stores. We can expect an increase in online and catalogue sales by maximizing the FANCL Group's multi-channel sales channels and inducing a switch from sales from direct stores and wholesale to online and catalogue sales. |

Increase in sales * Calculated with reference to COVID-19 |

||

| Improving corporate value through ESG evaluation |

Increased market valuation Corporate responses to climate change are becoming more important in investors' investment decisions. Proactive responses to climate change are expected to improve ESG evaluations and underpin stock prices. Over 40% of FANCL's issued shares are held by domestic and overseas institutional investors. Our active disclosure of climate change information may lead to an increase in our stock price. |

Stock valuation Note. Assuming a 1% increase in stock price |

Indicators and targets

The Sixth Assessment Report (AR6), adopted at the IPCC 58th Plenary Session in March 2023, suggests that climate change will progress faster than predicted by the Fifth Assessment Report (AR5). To achieve the long-term goal of 1.5 degrees※ of the Paris Agreement, it is clearly stated that it is necessary to "reduce greenhouse gas emissions by 60% by 2035 (compared with 2019 levels)." This suggests that there is a need for even stronger countermeasures than before. In the FANCL Group's Third Medium-Term Management Plan "Advance 2023" announced in the fiscal year ended March 2022, we significantly extended our climate change targets in response to global trends and national policies. We set a target of net zero emissions (Scope 1 + 2) by 2050.

The goal set in the Paris Agreement at COP21 in 2020 is to limit global warming to less than 1.5°C above the average global temperature at the time of industrialization from the late 18th century onwards (the Industrial Revolution).